Little Known Questions About Investment Advisors.

Retirement indicates various traits to everyone. It may be actually a certain factor in opportunity when you quit job, and also start a brand new phase of lifestyle.

Discover out when as well as exactly how to access your incredibly, then explore your retirement earnings choices. Or consider a transition to retirement life tactic.

Fascination About Investment Advisors

Analyze up the benefits and drawbacks if you are actually looking at downsizing your house, or even a reverse mortgage or property equity release item.

Distributions coming from previous companies' retirement programs can be spun over to the SRP. The Educator Insurance Coverage and Annuity Affiliation (TIAA) is the main company of recordkeeping companies for the Retirement Strategy accounts.

Along with dollar-cost averaging, you typically buy less portions when the market is higher and also more shares when read more the marketplace is actually reduced. This step-by-step approach can aid you slowly develop riches by branching out the prices at which you purchase more shares of a stock. (Not either price growth nor revenue is guaranteed, however.) It is actually a means to dodge the threat of getting way too much at high prices and also very little at affordable price.

Not known Facts About Investment Advisors

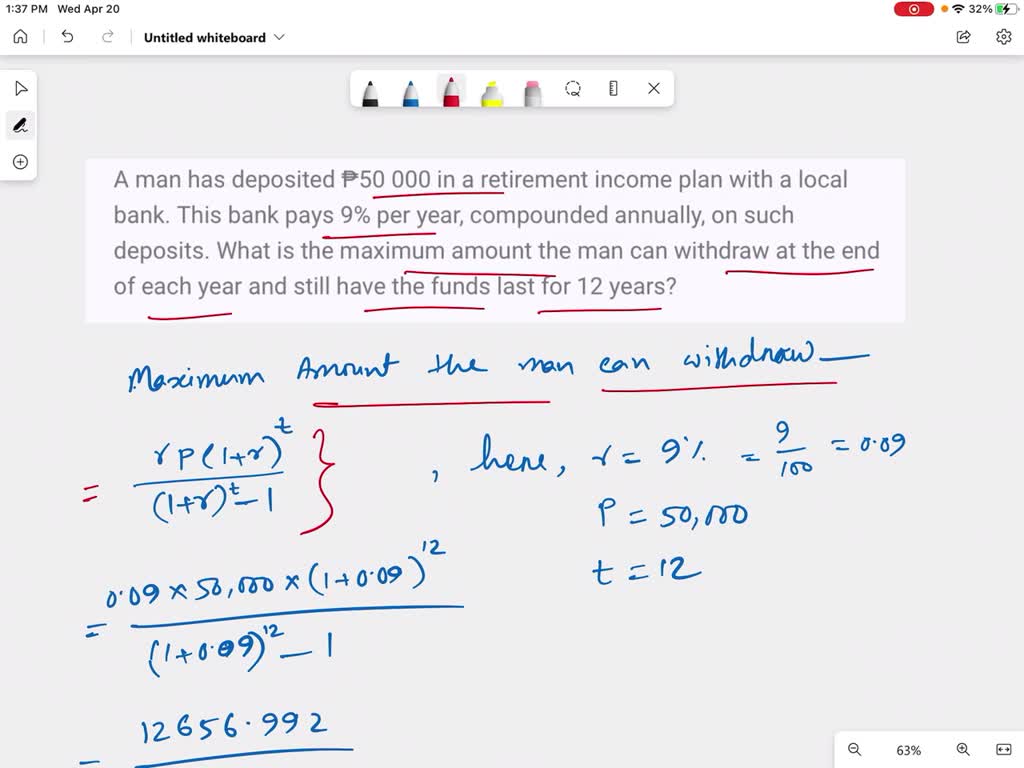

If you perform this before you receive utilized to having the additional income, you might certainly not even see a distinction. You may withdraw funds from an IRA account prior to you reach age 59, it is actually normally certainly not a great tip. For starters, you'll need to spend taxes as well as probably a 10% IRS very early drawback penalty on incomes as well as pre-tax additions you withdraw.

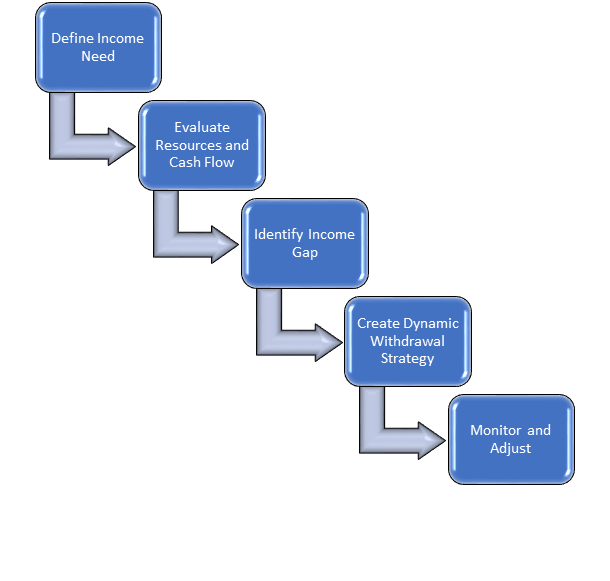

Figure out how an advisor can easily partner with you when you're retired to help you choose to satisfy your revenue, insurance policy and also financial investment requirements.

Listed here is actually exactly how it functions: Let's claim you possess $160,000 to commit. If you choose to utilize a CD step ladder, you could possibly place $40,000 in a 12-month CD, yet another $40,000 in a 24-month compact disc, and also the very same in 36- and 48-month CDs. After the very first news one year, you can easily either use the cash coming from the visit this website 12-month compact disc or reallocate it to a 48-month CD to always keep the ladder going.

If you enjoy your current job, you could possibly look into staying on the group, just in a part time part. This way you can carry on to acquire the total satisfaction as well as fulfillment that your job supplies while not imperiling the liberty you prefer out of retirement life. Or, if you will choose to leave your existing firm, you could explore other part time tasks in areas that fascinate you.

The 9-Minute Rule for Investment Advisors

A (Lock A secured padlock) or https:// suggests you've safely connected to the. gov site. Reveal vulnerable info merely on official, safe and secure sites (investment advisors).

This is a foundational source of revenue for the majority of people. When you decide to take it may have a significant impact on your retirement.

Comments on “Little Known Facts About Investment Advisors.”